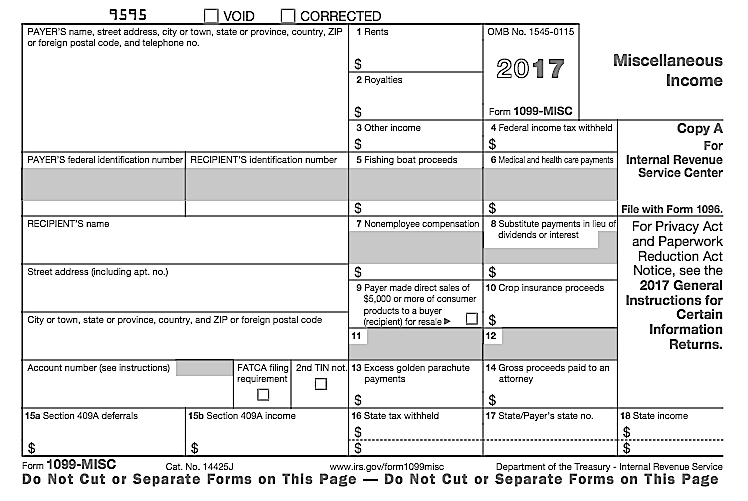

When you start your own business or provide services on a contract basis, you may have questions about the setup or how to handle certain situations as they arise. FAQs about sole proprietors and independent contractors However, a sole proprietor might receive a 1099 form from their client, depending on the type of services provided. A sole proprietor must track their own business expenses, while an independent contractor will receive a 1099 form that outlines the income earned during the previous calendar year. The main difference between a sole proprietor and an independent contractor is the way compensation is reported. Work for themselves rather than an employer Pay self-employment taxes on business income Separate their business expenses from personal expenses The two classifications are similar in that those in both roles: Instead, they provide services or goods to clients individually and do not receive a set salary for their work. Sole proprietors and independent contractors are both self-employed individuals who are not classified as employees. Related: Becoming an Independent Contractor: Pros and Cons Sole proprietor vs. Companies and clients that use the services of independent contractors must send these forms by January 31 to provide adequate time for the contractor to prepare and file their taxes. This will be the form used going forward to report non-employee compensation. All the income listed on each form would be included on the contractor's tax return, and all required self-employment taxes must be paid from those forms.įor the 2020 tax year, the IRS replaced the 1099-MISC form with the 1099-NEC form. Independent contractors who work with multiple clients would receive multiple 1099-MISC forms. Contractors who earn at least $600 from a client or company will receive a 1099-MISC form from that client or company, which outlines the total income received for the calendar year.

Independent contractors often work in creative and technical fields, such as web development, content creation, graphic design or IT.Īn independent contractor may also be referred to as a 1099 employee, which refers to the tax form provided at the end of the year. Companies that hire independent contractors do not withhold payroll taxes from their pay unless the contractors are subject to backup withholding. They may be paid by the hour or per project, depending on the terms of their contract. An independent contractor receives payment based on the work they do. Independent contractors are also self-employed individuals who provide services to clients and corporations but are not employees. Related: What is a Sole Proprietorship? Definition, Advantages and Disadvantages What is an independent contractor? When you start a business and separate your business income and expenses from your personal income and expenses, you have effectively created a sole proprietorship and you are now considered to be a sole proprietor.

1099 INDEPENDENT CONTRACTOR EXPENSES LICENSE

You do not have to register your business with the state or federal government, obtain a business license or secure your business name in order to operate as a sole proprietorship. The default business structure for a small business is a sole proprietorship. Self-employment tax is approximately 15.3% of your net income. Sole proprietors are also responsible for paying their own self-employment taxes, which include Social Security and Medicare taxes. When you are self-employed, you do not work for an employer that pays a consistent wage or salary but rather you earn income by contracting with and providing goods or services to various clients. Those who expect to pay at least $1,000 in income tax must file estimated taxes.Ī sole proprietor is self-employed because they operate their own business. You pay taxes on your business income on your personal tax return each year, although you will file the IRS Form 1040 Schedule C to outline your business income and expenses. If you operate a sole proprietorship, you are personally liable for any business debts and legal obligations. A sole proprietorship is an unincorporated business structure that is run by a single individual. What is a sole proprietor?Ī sole proprietor is an individual who owns and operates a business alone. independent contractor and the differences between the two. In this article, we will discuss sole proprietor vs. The setup of your business and how you operate it may also determine whether you are a sole proprietor or independent contractor. Both of these business structures allow an individual to operate independently, but they may differ in the way the operator is taxed. When you are self-employed, you may wonder whether you are a sole proprietor or independent contractor.

0 kommentar(er)

0 kommentar(er)